In the current worldwide university ranking in actuarial science published by the University of Nebraska, the University of Ulm achieves an excellent 3rd place in comparison to all international universities (non-business schools). This excellent result underlines that the Ulm University is one of the world's leading universities in the field of actuarial science. [Press release of the University of Ulm (in German)]

10th Ulm Actuarial Day online!

We are very pleased to share two in-depth presentations on current topics here and with the actuarial community through actuview (the first permanent and international media platform for actuaries):

- Scanning the Horizon: Integrating Expert Knowledge into the Calibration of Stochastic Mortality Models

Arne Freimann - Intertemporal Smoothing and Intergenerational Risk Sharing: The Impact on Objective Utility and Subjective Attractiveness of Retirement Savings Products

Timon Kramer

Professor Dr. An Chen (Ulm University) co-organized the Workshop for Young Mathematicians on Nov 13-15, 2024 in Castle Reisensburg for German Society for Insurance and Financial Mathematics (DGVFM). Eight renowed speakers from academia and practice have provided extremely interesting up-to-date insights in various fields of actuarial science: Prof. Dr. Hansjörg Albrecher (Université de Lausanne), Prof. Dr. Jan-Philipp Schmidt (TH Köln), Prof. Dr. Manuel Rach (Universität St. Gallen), Prof. Dr. Luitgard Veraart (London School of Economics and Political Science), Dr. Dorothee Riemann (Gen Re), Constantin Papaspyratos (Bund der Versicherten), Prof. Dr. An Chen (Universität Ulm) and Prof. Dr. Jörn Saß (RPTU Kaiserslautern-Landau). The topics vary from reinsurance and how to price for a catastrophe cover as well as the challenges of climate change for insurers, dynamic pricing approaches, valuation and design of sustainability-linked bonds, compression of insurance portfolios, to issues related to supervisory and contractual aspects. Around 30 master, bachelor and Ph.D students attended the workshop and enjoyed fruitful discussions with the speakers and the cozy atmosphere of the workshop.

Dr. Yusha Chen was awarded the 2nd SCOR Actuarial Award Germany 2024 for her dissertation with the title

"Life Insurance Companies: Product Design, Marketing, and Investment".

Many congratulations to Yusha!

Dr Shihao Zhu (who got PhD at IMW at Bielefeld University under the supervision of Prof. Dr. Giorgio Ferrari and is now a postdoc at IVW at Ulm University) received an Excellence Award for his doctoral thesis entitled "On Some Stochastic Control Models and Related Free-boundary Problems in Insurance Mathematics".

Dr Arne Freimann (who works for ifa - Institut für Finanz- und Aktuarwissenschaften) received an Excellence award for his doctoral thesis on “Pricing, Hedging, and the Roles of Different Market Players in the Longevity Risk Transfer Market” which was supervised by Prof. Dr. Jochen Russ.

Congratulations to both for this fantastic recognition!

Many thanks to the Verein zur Förderung der Versicherungswissenschaft in Hamburg e. V. (VFVH) for supporting young talents in insurance!More information: Link

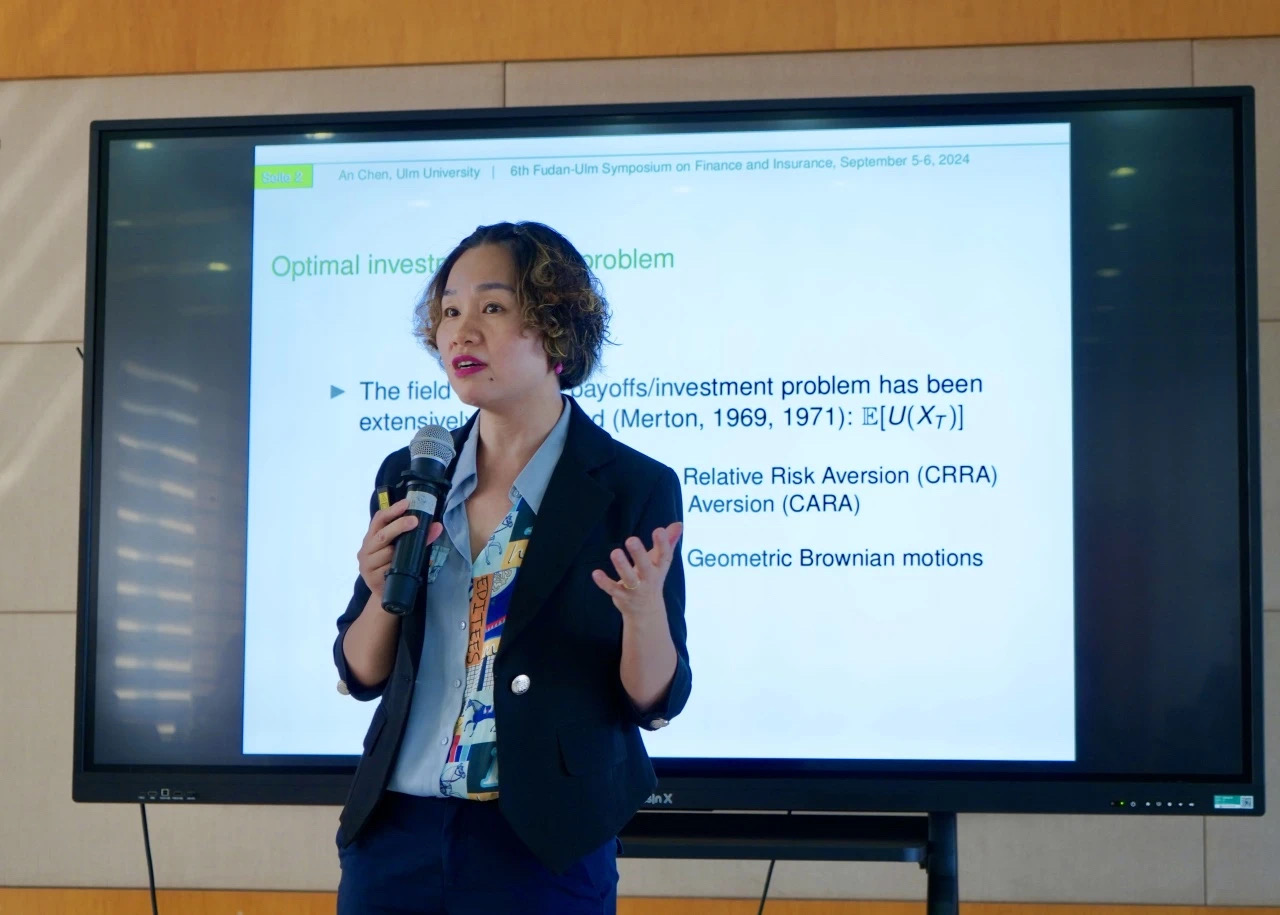

The 6th Fudan-Ulm Symposium on Finance and Insurance took place at the School of Economics, Fudan University, from September 5 to 6, 2024. Co-hosted by Fudan University’s School of Economics and Ulm University’s Faculty of Mathematics and Economics, with support from the International Finance and Insurance Association (IFIA), this event showcased cutting-edge research across a range of topics including asset allocation, risk management, insurance product design, and more.

This year's symposium was a significant event for the insurance discipline in Fudan and Ulm, attracting participants from various universities and industry professionals, and fostering lively discussions and future collaboration. We look forward to the next edition at Ulm University!

This year's Foundations and Applications of Decentralized Risk Sharing (FADeRiS) conference took place over three days from May 27-29 at Universität Ulm at the beautiful 10th century historic Reisensburg Castle - organized by An Chen (Ulm University) and Peter Hieber (University of Lausanne - HEC Lausanne).

FADeRiS is a conference series dedicated to the theory and practical application of decentralized risk-sharing schemes. Decentralized risk-sharing refers to risk-sharing mechanisms under which the participants in a pool decide to share their risks among themselves, as opposed to classical insurance where an insurance provider takes relevant risks. Examples include peer-to-peer (P2P) insurance, pooled annuity funds or tontines.

Many thanks to all participants for this wonderful conference!

Further information about the conference can be found in the expandable text field.

Detailed information

The first day of the conference featured inspiring presentations on user-friendly metrics for annuitants and the Hashtagethics of mortality risk sharing. The second day focused on various aspects of risk sharing and risk management. Morning sessions covered topics such as efficient Hashtaguncertainty sharing, risk under Hashtagambiguity, and the impact of Hashtagclimate change on natural catastrophe risk pooling. In the afternoon, sessions explored the nuances of Hashtagtontines, including their financial Hashtagguarantees and actuarial Hashtagfairness, as well as the impact of Hashtagmortality dynamics on mutual Hashtagrisk sharing. The third day concluded the conference with presentations on economics and mathematics of risk sharing, as well as belief-neutral HashtagPareto efficiency and robust peer-to-peer risk sharing

In addition to cutting-edge scientific presentations, there were many opportunities for scientific exchange and networking.

The full program, more information about this year's conference and also about the first edition - initiated by Jan Dhaene, Mario Ghossoub, and Michel Denuit - which took place at KU Leuven, can be found here:

Many thanks to all participants for this wonderful conference!

Hansjörg Albrecher (University of Lausanne - HEC Lausanne)

Michail Anthropelos (University of Piräus)

Mücahit Aygün (University of Amsterdam)

Patrick Beiẞner (Australian National University)

Carole Bernard (Grenoble Ecole de Management, Vrije Universiteit Brussel)

Tim Boonen (University of Hong Kong, HKU)

An Chen (Ulm Univerity)

Sascha Günther (University of Lausanne - HEC Lausanne)

Mario Ghossoub (University of Waterloo)

Peter Hieber (University of Lausanne - HEC Lausanne)

Rodrigue Kazzi (KU Leuven)

Roger Laeven (University of Amsterdam)

Felix-Benedikt Liebrich (University of Amsterdam)

Liyuan Lin (University of Waterloo)

Mario Marino (University of Trieste, Italy)

Thai Nguyen (Université Laval, Canada)

Annamaria Olivieri (Università di Parma, Italy)

Patricia Ortega Jiménez (UC Louvain)

Manuel Rach (University of St. Gallen)

Frank Riedel (University of Bielefeld)

Mitja Stadje (University of Ulm)

Julien Trufin (Université Libre de Bruxelles)

Emiliano Valdez (University of Connecticut)

Steven Vanduffel (Vrije Universiteit Brussel)

Ruodu Wang (University of Waterloo)

Morten Wilke (Vrije Universiteit Brussel, University of Ulm)

Shihao Zhu (Ulm University)

On March 5th 2024 the 15th DGVFM CPD Day took place. The workshop was hosted by SV SparkassenVersicherung in Stuttgart and organized by the HAW-Ausschuss DGVFM (lead: Prof. Dr. An Chen (Universität Ulm) and Prof. Dr. Stefan Weber (Leibniz Universität Hannover)) and Dr. Michael Kochanski (appointed actuary SV SparkassenVersicherung) with the topic "Financial Planning for Retirement: Analyzing Costs and Strategies".

Participants were able to gain insights from research and practice through the following presentations:

- Inroduction, Prof. Dr. An Chen (Universität Ulm) and Dr. Michael Kochanski (SV SparkassenVersicherung)

- Value for Money, Dr. Tobias Rieck (Allianz Life)

- Financial Literacy and Retirement Planning, Prof. Dr. Tabea Bucher-Koenen (Universität Mannheim)

- Retirement planning - what should it cost or what must it achieve?, Prof. Dr. Ralf Korn (Rheinland-Pfälzische Technische Universität Kaiserslautern-Landau (RPTU))

The recordings of the presentations will be available soon via actuview: Link

Many thanks to the speakers for their excellent presentations and to SV SparkassenVersicherung for being a great host!

The International Actuarial Association (IAA) has awarded the Chris Daykin Prize 2023 for the best pension relatd paper in the ASTIN Bulletin to Prof. Dr. An Chen and former IVW PhD student Dr. Fangyuan Zhang (joint work with Prof. Dr. Motonobu Kanagawa, EURECOM). The ASTIN Bulletin is one of the most prestigious journals in the field of actuarial science.

In their paper, they analyze a collective defined contribution pension system with multiple overlapping generations. They solve a mathematically complex Bayesian optimization problem and analyze for which persons and under which conditions the welfare can be improved by intergenerational risk sharing. In particular, the results show that intergenerational risk sharing in volatile financial markets leads to an increase in welfare for risk-averse individuals. The analyses are highly relevant for both research and practice, e.g. for pension funds.

Congratulations!

9th Ulm Actuarial Day online!

We are very pleased to share three interesting in-depth presentations on current topics with the actuarial community through actuview (the first permanent and international media platform for actuaries):

- Multistate Analysis of Policyholder Behaviour in Life Insurance – Lasso-based Modelling Approaches (Link)

Lucas Reck - Why Companies Tend to Postpone the CSR Investments: An Explanation Using a Real Option Framework (Link)

Leonard Gerick - Life Reinsurance Under Perfect and Asymmetric Information (Link)

Maria Hinken

Professor Dr. An Chen (Ulm University) co-organized the Workshop for Young Mathematicians on Nov 28-30, 2022 in Castle Reisensburg for German Society for Insurance and Financial Mathematics (DGVFM), together with Professor Dr. Alfred Müller (University of Siegen). Seven outstanding speakers from academia and practice have provided extremely interesting up-to-date insights in various fields of actuarial science: Prof. Dr. Christoph Belak (TU Berlin), Prof. Dr. Pierre Devolder (UC Louvain), Prof. Dr. Rüdiger Kiesel (University of Duisburg-Essen), Uwe Michel (Executive Vice President and Head of Asia Division of Allianz S.E.), and Dr. Michael Kochanski (Actuary at Sparkassen Versicherung), Prof. Dr. Steven Vanduffel (Vrije Universiteit Brussel), and Prof. Dr. Elena Vigna (University of Turin, Italy). The topics vary from life and pension insurance, asset liability management, model risk, Allianz in Asia, machine learning, to issues related to emerging risks, such as carbon risk. Over 30 master and Ph.D students attended the workshop and enjoyed fruitful discussions with the speakers and the cozy atmosphere of the workshop.